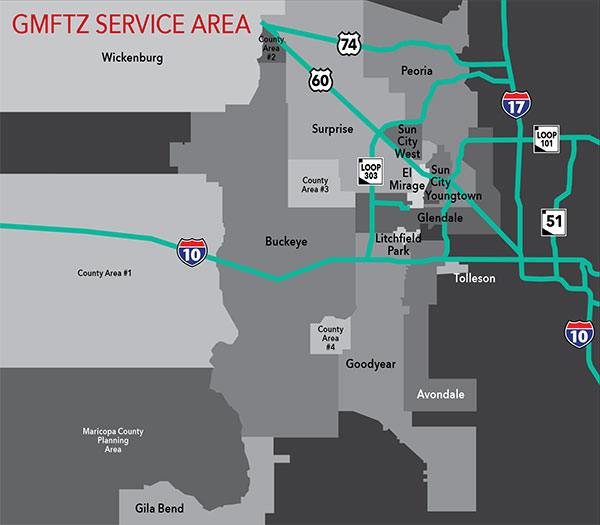

Peoria has worked with companies on establishing themselves within the Western Maricopa Foreign Trade Zone. This includes working to get paperwork filed and necessary approvals. All sites are within this zone.

Merchandise can be brought duty-free into a designated Foreign Trade Zone (FTZ) for purposes of storing, repacking, display, assembly or manufacturing. Imports may be landed and stored without full customs formalities. Arizona is the only state that provides an 80 percent reduction in real and personal property taxes for companies qualifying for FTZ or sub-zone designation. This is a federal program, not a City of Peoria program.

Benefits within a Foreign Trade Zone

Property Tax Savings

Only in Arizona

- Reduce Arizona real and personal/equipment property taxes on investments by as much as 72%.

- Arizona state law allows for any property in a FTZ that is approved and activated to be re-classified down from 18% valuation to 5% valuation.

Reduced Fees / Streamlined Procedures

Used by 45 of the top 100 importers in the U.S.

- Reduced paperwork – Consolidated weekly entry process reduces fees.

- Reduced supply chain time – Faster customer clearance with special direct delivery procedures.

- Lower fees – Reduction can be up to $1 million in savings annually.

- Duty Deferral and Reduction – Duty is paid on end products only when goods enter the U.S.

- Duty Elimination – Foreign merchandise in the FTZ may be re-exported free of duty and federal excise tax. No duty is paid on goods scrapped, wasted or destroyed in an FTZ.

Security

- Activated FTZ operators enjoy the highest level of security. This allows operators to negotiate lower insurance rates.

For more information on the benefits within a Foreign Trade Zone: WMFTZ Brochure (PDF)